We are ready to play a key role in your retirement planning.

Traditional and Roth IRAs

Let us help explain the tax benefits of these popular individual retirement accounts.

Make your move

We can help you open a new account or move funds from one type of account to another.

Steady earnings

By starting early, you can collect our competitive dividend payments for years on end.

Total security

All IRA deposits up to $250,000 are protected by the National Credit Union Administration.

Let's get your questions answered and your savings started.

When it comes to retirement, you may have some questions. How much money will you need? What is the best way to save it? Should you get a Traditional or Roth IRA? Can you open an IRA in addition to a work-based 401(k)? At South Carolina Federal Credit Union, we have the answers you are looking for.

- Contribute up to $7,000 annually to your IRA Savings Account ($7,500 if over age 50).

- Choose Traditional or Roth IRAs that grow at competitive rates.

- With Roth IRAs, qualified withdrawals are tax-free.

- With both Traditional and Roth IRAs, dividends are tax-exempt.

- With Traditional IRAs, you may be able to take a tax deduction for any year you make a contribution.

- Deposits up to $250,000 insured by National Credit Union Administration.

- With $50,000 in your IRA Savings*, you can open a Jumbo IRA Share Certificate.

- Contribute up to $2,000 per year per student.

- Any family member - including parents, grandparents, aunts and uncles - can contribute to a child's ESA.

- Annual dividend earnings are tax-exempt and all qualified withdrawals are tax-free.

- Funds can be used for higher education and private elementary and secondary schools.

- Qualified expenditures include tuition, room and board, fees, and educational equipment such as laptop computers.

Effective Date: November 19, 2024

| Term | Dividend Rate | Annual Percentage Yield1 |

|---|---|---|

| 3 Months | 1.49% | 1.50% |

| 6 Months | 1.83% | 1.85% |

| 12 Months | 2.23% | 2.25% |

| 18 Months | 2.28% | 2.30% |

| 24 Months | 2.47% | 2.50% |

| 36 Months | 2.72% | 2.75% |

| 36 Months Step-Up | 2.62% | 2.65% |

| 60 Months | 3.93% | 4.00% |

Open an IRA Savings account.

You can open an account by visiting a financial center, calling (800) 845-0432, or online.

To view Checking account options and learn more, click here.

To view Savings account options and learn more, click here.

Required documents:

The following accounts require personal attention, specific documentation and are not opened online: Trust, Individual Retirement Accounts (IRAs), estate accounts, business accounts, teen accounts and Kids Savings accounts. Please visit a financial center for assistance with these accounts.

To view Checking account options and learn more, click here.

To view Savings account options and learn more, click here.

Required documents:

- A valid driver's license or government-issued photo ID

- U.S. Social Security Number

- Credit/debit card to fund the account

- Make an Appointment and What to Bring Information

The following accounts require personal attention, specific documentation and are not opened online: Trust, Individual Retirement Accounts (IRAs), estate accounts, business accounts, teen accounts and Kids Savings accounts. Please visit a financial center for assistance with these accounts.

- You can locate your account number by clicking on the eye icon within Online or Mobile Banking99All of our Digital Banking products require an Online Banking login, and in some cases, enrollment into Bill Pay. Terms and conditions are available through Online Banking and must be agreed to before use. Mobile Banking products also require a data plan with a wireless provider. South Carolina Federal Credit Union provides Mobile Banking as a free service. Consult your provider for any fees associated with your mobile web service, such as message and data rates..

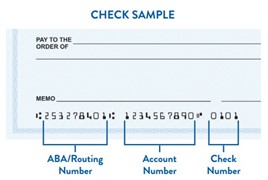

- If you have checks for your account, your account number is the second string of characters printed on the bottom of your checks:

- You can also view your account number on your membership card that you received when you opened your account.

To sign up for Online Banking6All of our Digital Banking products require an Online Banking login, and in some cases, enrollment into Bill Pay. Terms and conditions are available through Online Banking and must be agreed to before use. Mobile Banking products also require a data plan with a wireless provider. South Carolina Federal Credit Union provides Mobile Banking as a free service. Consult your provider for any fees associated with your mobile web service, such as message and data rates., click on "Login" at the top of the screen, then click on "First Time User," and follow the prompts.

To sign up for Mobile Banking, download the app from the App Store or Google Play by searching for "South Carolina Federal Credit Union." If you already have an Online Banking User ID and password, you can use it to log in. Or, click on "enroll now" to establish a User ID and password.

To sign up for Mobile Banking, download the app from the App Store or Google Play by searching for "South Carolina Federal Credit Union." If you already have an Online Banking User ID and password, you can use it to log in. Or, click on "enroll now" to establish a User ID and password.

If you have registered for Online Banking99All of our Digital Banking products require an Online Banking login, and in some cases, enrollment into Bill Pay. Terms and conditions are available through Online Banking and must be agreed to before use. Mobile Banking products also require a data plan with a wireless provider. South Carolina Federal Credit Union provides Mobile Banking as a free service. Consult your provider for any fees associated with your mobile web service, such as message and data rates., you are automatically enrolled in eStatements.

Managing your money made easy.

Simplify money management with flexible checking features that fit your lifestyle.