Our checking accounts let you choose your definition of "convenient."

Select the options that fit your needs and we'll recommend the best solution.

Reset your product finder answers at any time

Reset selections

25-and-Under Simple Checking

Get your financial journey started with all the benefits of our Simple Checking account, without the worry of a monthly maintenance fee.

- No monthly checking fee.

- Free Online Banking, Mobile Banking*, and Bill Pay.

Military Friendly Checking

For your dedication and service, you deserve the best. That's why we waive the monthly maintenance fee on our best checking account.

- Discounted vehicle loan rates and safe deposit boxes.

- Free foreign ATM use.

Rewards Debit Card

Sure, they make purchasing easier. And you can get cash from ATMs. But at South Carolina Federal Credit Union, our debit card offers so much more.

- Premium checking members can earn points and shop for rewards.

- Mastercard® security benefits.

Thank you for your interest in South Carolina Federal Credit Union.

This form is not a secure form of communication. If any confidential information such as account numbers, SSNs, etc. is necessary, it will not be obtained until we have contacted you. This is another way South Carolina Federal works to keep your information secure.

Please document or make a note of the details of your pending transactions, as you will not be able to tell within Online Banking until the transaction posts.

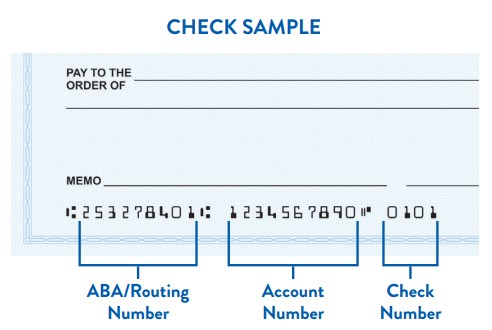

- South Carolina Federal's routing (MICR) number is the string of characters that appears at the bottom left of your check (253278401).

- To locate your account number:

- The second set of numbers appear on the right side of the check.

- To find your account in Online Banking, click on the corresponding account in Online Banking, then elect Account Information.

If your transaction was a deposit, it will have a "+" next to it. Your withdrawals will not have a symbol next to them.

You can open an account by visiting a financial center, calling (800) 845-0432, or online.

To view Checking account options and learn more, click here.

To view Savings account options and learn more, click here.

Required documents:

The following accounts require personal attention, specific documentation and are not opened online: Trust, Individual Retirement Accounts (IRAs), estate accounts, business accounts, teen accounts and Kids Savings accounts. Please visit a financial center for assistance with these accounts.

To view Checking account options and learn more, click here.

To view Savings account options and learn more, click here.

Required documents:

- A valid driver's license or government-issued photo ID

- U.S. Social Security Number

- Credit/debit card to fund the account

The following accounts require personal attention, specific documentation and are not opened online: Trust, Individual Retirement Accounts (IRAs), estate accounts, business accounts, teen accounts and Kids Savings accounts. Please visit a financial center for assistance with these accounts.

- You can locate your account number by clicking on the eye icon within Online or Mobile BankingmobileSouth Carolina Federal Credit Union provides Mobile Banking as a free service. Consult your provider for any fees associated with your mobile web service, such as message and data rates test..

- If you have checks for your account, your account number is the second string of characters printed on the bottom of your checks:

- You can also view your account number on your membership card that you received when you opened your account.

Make informed financial decisions with helpful resources.